The governor of Pakistan’s central bank confirmed on Wednesday that the country received Chinese loans last month, helping to stave off a foreign currency crisis as Islamabad finds itself caught in growing global pressure on emerging markets.

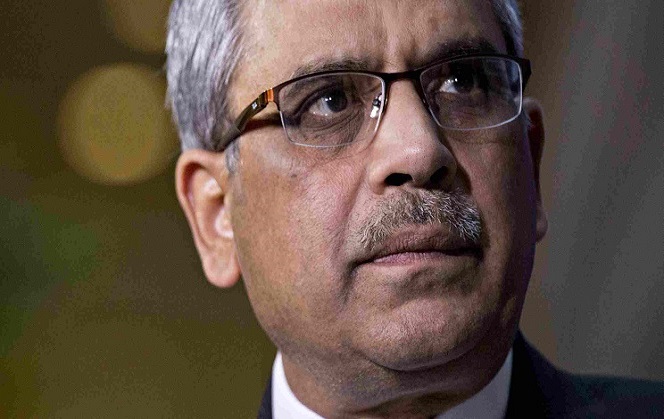

Talking to the Financial Times, State Bank Governor Tariq Bajwa confirmed that Pakistan received one billion US dollars’ worth of loans at “good, competitive rates” from Chinese banks after official data showed the country’s foreign currency reserves almost halved in the past two years.

Pakistan previously secured Chinese loans worth 1.2 billion US dollars in the 12 months prior to April 2017, with authorities in Islamabad keen to avoid seeking financial aid at the International Monetary Fund, a route the country has been forced to take 12 times in the past 30 years.

Pakistan’s foreign currency reserves have dropped from over 18 billion US dollars to 10.8 billion, with the country struggling with low exports and increasing imports.

While Bajwa told the Financial Times that “Chinese commercial banks are awash with liquidity,” critics have said authorities are not doing enough to handle structural problems within the economy.

A lack of fiscal discipline has seen Pakistan’s budget deficit reach a record 1.48 trillion rupees (12.8 billion US dollars) in the first nine months of the fiscal year, equal to 4.3 percent of the country’s GDP, according to Finance Ministry data released on Tuesday.

Pakistani newspaper The Express Tribune blamed “inexperienced bureaucrats” within the ministry for the lack of control over government expenditure.

A report published by Moody’s earlier this week predicted Pakistan’s rupee could plummet in value by as much as 7.75 percent in the next 12 months, after already being devalued by 10 percent since December.

In the face of an increasingly strong US dollar, that currency slide could get even worse, with Pakistan suffering from many of the same issues seen in other emerging markets in recent weeks.

A recent tendency for short-term foreign currency loans has seen Pakistan spend 1.172 trillion rupees (10.1 billion US dollars) on servicing debt in the last nine months, equal to 86 percent of the annual budget estimate. The strong dollar and a weak rupee will only make that debt more expensive.

However, the 54 billion US dollar investment from China via the China-Pakistan Economic Corridor (CPEC) is expected to solve significant infrastructure problems across the country.

Emerging markets from Argentina to Turkey have come under intense pressure over falling currencies in the face of internal problems and a strong dollar.

On Wednesday Turkish authorities were forced to boost a benchmark lending rate from 13.5 to 16.5 percent, despite President Recep Tayyip Erdogan’s vocal opposition to any interest rate rises, ahead of next month's general election.

The move came after Turkey’s lira plummeted to yet another record low earlier in the day, continuing a trend that had seen it lose almost 20 percent of its value since the start of the year.

(From:CGTN)